Annual Information Statement or AIS is comprehensive view of information for a taxpayer displayed in Form 26AS. During preparation of AIS, information processing is required to display complete and accurate information to the taxpayer.

1. Objectives

The key objective of AIS are:

• Display complete information to the taxpayer

• Promote voluntary compliance and enable seamless prefiling of return

• Deter non-compliance

2. AIS Features

Salient Features of new AIS are as under:

• Inclusion of new information (interest, dividend, securities transactions, mutual fund transactions, foreign remittance information etc.)

• Use of Data Analytics to populate PAN in non-PAN data for inclusion in AIS.

• Deduplication of information and generation of a simplified Taxpayer Information Summary (TIS) for ease of filing return (pre-filling will be enabled in a phased manner).

• Taxpayer will be able to submit online feedback on the information displayed in AIS and also download information in PDF, JSON, CSV formats.

• AIS Utility will enable taxpayer to view AIS and upload feedback in offline manner.

• AIS Mobile Application will enable taxpayer to view AIS and upload feedback on mobile.

| Disclaimer: Annual Information Statement (AIS) includes information presently available with Income Tax Department. There may be other transactions relating to the taxpayer which are not presently displayed in Annual Information Statement (AIS). Taxpayer is expected to check all related information and report complete and accurate information in the Income Tax Return. |

The schematic flow of information

3. AIS Preparation

Some key information processing steps are:

• PAN Population: In case no valid PAN is available in the submitted information, the PAN will be populated on matching Aadhaar and other key attributes.

• Information Display: Generally, the reported information is displayed against the reported PAN holder. The information display logic for specific information such as property, bank account, demat account etc. aims to show information to relevant PAN holders to enable review and submission of feedback

• Information Deduplication: In case where similar information is reported under different information types (e.g. reporting of interest/dividend in SFT and TDS) the information with lower value will be marked as “Information is duplicate / included in other information” using automated rules.

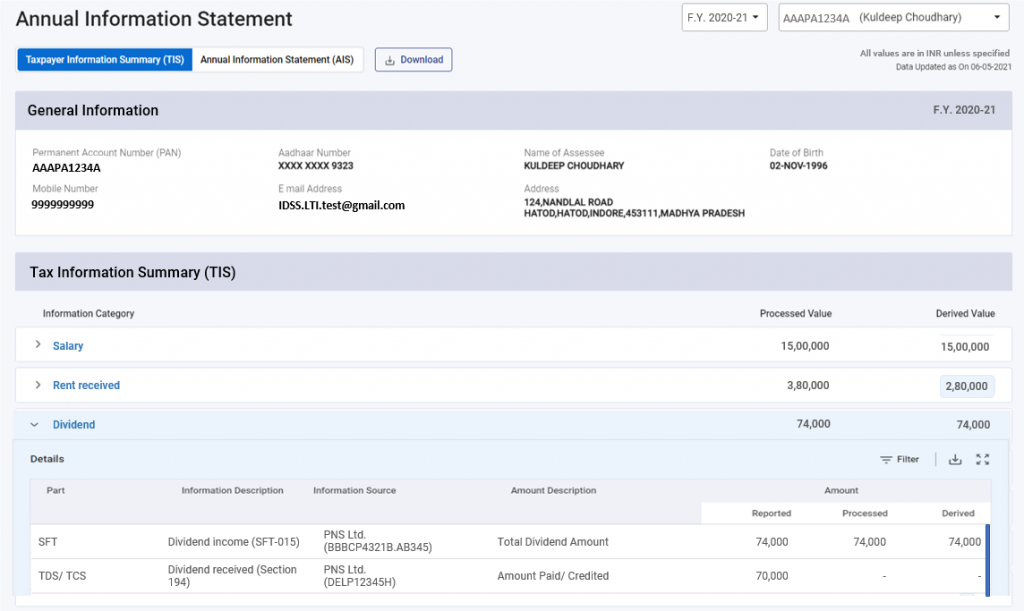

• Taxpayer Information Summary (TIS) preparation: The information category wise aggregated information summary for a taxpayer is prepared after deduplication of information based on pre-defined rules. It shows processed value (i.e., value generated after deduplication of information based on pre-defined rules) and derived value (i.e., value derived after considering the taxpayer feedback and processed value) under each information category (e.g., Salaries, Interest, Dividend etc.). The derived information will be used for prefilling of Return.

4. AIS Feedback

The taxpayer will be able to view AIS information and submit following types of response on the information:

• Information is correct

• Information is not fully correct

• Information relates to other PAN/Year

• Information is duplicate / included in other information

• Information is denied

• Customized Feedback

Illustrations

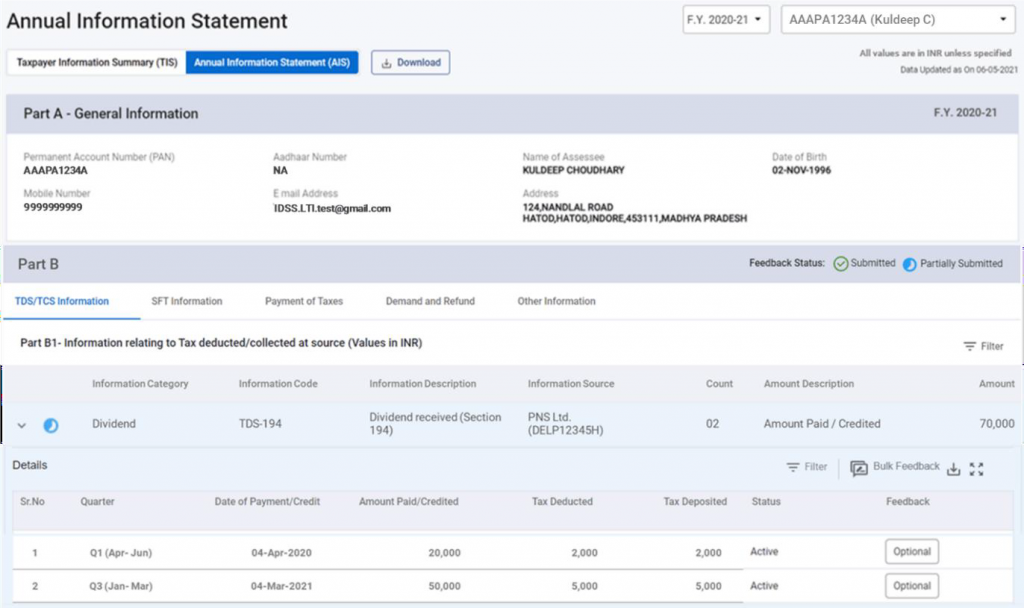

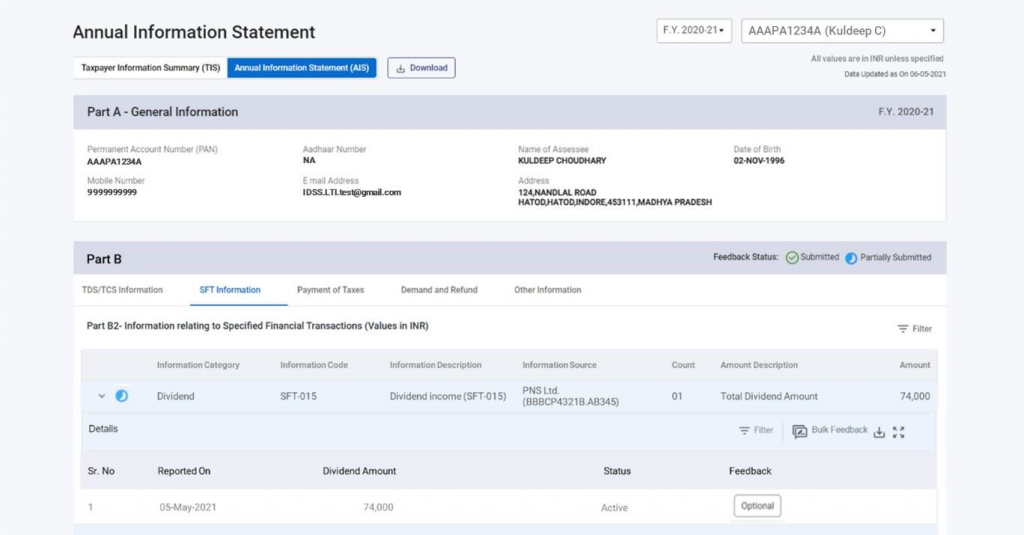

Illustration 1: Display of information reported under both TDS and SFT

Payment of dividend above Rs 5,000 is required to be reported under TDS Statement. Under SFT all dividend payment is required to be reported. In this case, Dividend payment of Rs 70,000 was reported by the Deductor (TAN based) under TDS and 74,000 was reported under SFT by the reporting entity.

Annual Information Statement (AIS)

TDS – Information source (L2 level)

SFT – Information source (L2 level)

Note: In AIS, TDS information and SFT information is reported under sections B1 and B2.

Taxpayer Information Summary (TIS)

Note: Information reported under TDS is marked as Duplicate during Processing.

5. AIS Information Category

The broad categories of Information in AIS summary view are as under:

The key information sources, approach for AIS processing and AIS summary preparation is explained in following paragraphs.

01. Salary

02. Rent received

03. Dividend

04. Interest from savings bank

05. Interest from deposit

06. Interest from others

07. Interest from income tax refund

08. Rent on plant & machinery

09. Winnings from lottery or crossword puzzle u/s 115BB

10. Winnings from horse race u/s 115BB

11. Receipt of accumulated balance of PF from employer u/s 111

12. Interest from infrastructure debt fund u/s 115A(1)(a)(iia)

13. Interest from specified company by a non-resident u/s 115A(1)(a)(iiaa)

14. Interest on bonds and government securities

15. Income in respect of units of non-resident u/s 115A(1)(a)(iiab)

16. Income and long-term capital gain from units by an offshore fund u/s 115AB(1)(b)

17. Income and long-term capital gain from foreign currency bonds or shares of Indian companies’ u/s 115AC

18. Income of foreign institutional investors from securities u/s 115AD(1)(i)

19. Insurance commission

20. Receipts from life insurance policy

21. Withdrawal of deposits under national savings scheme

22. Receipt of commission etc. on sale of lottery tickets

23. Income from investment in securitization trust

24. Income on account of repurchase of units by MF/UTI

25. Interest or dividend or other sums payable to government

26. Sale of land or building

27. Receipts for transfer of immovable property

28. Sale of vehicle

29. Sale of securities and units of mutual fund

30. Off market debit transactions

31. Off market credit transactions

32. Business receipts

33. Business expenses

34. Rent payment

35. Miscellaneous payment

36. Cash deposits

37. Cash withdrawals

38. Cash payments

39. Outward foreign remittance/purchase of foreign currency

40. Receipt of foreign remittance

41. Payment to non-resident sportsmen or sports association u/s 115BBA

42. Foreign travel

43. Purchase of immovable property

44. Purchase of vehicle

45. Purchase of time deposits

46. Purchase of securities and units of mutual funds

47. Credit/Debit card

48. Balance in account

49. Income distributed by business trust

50. Income distributed by investment fund