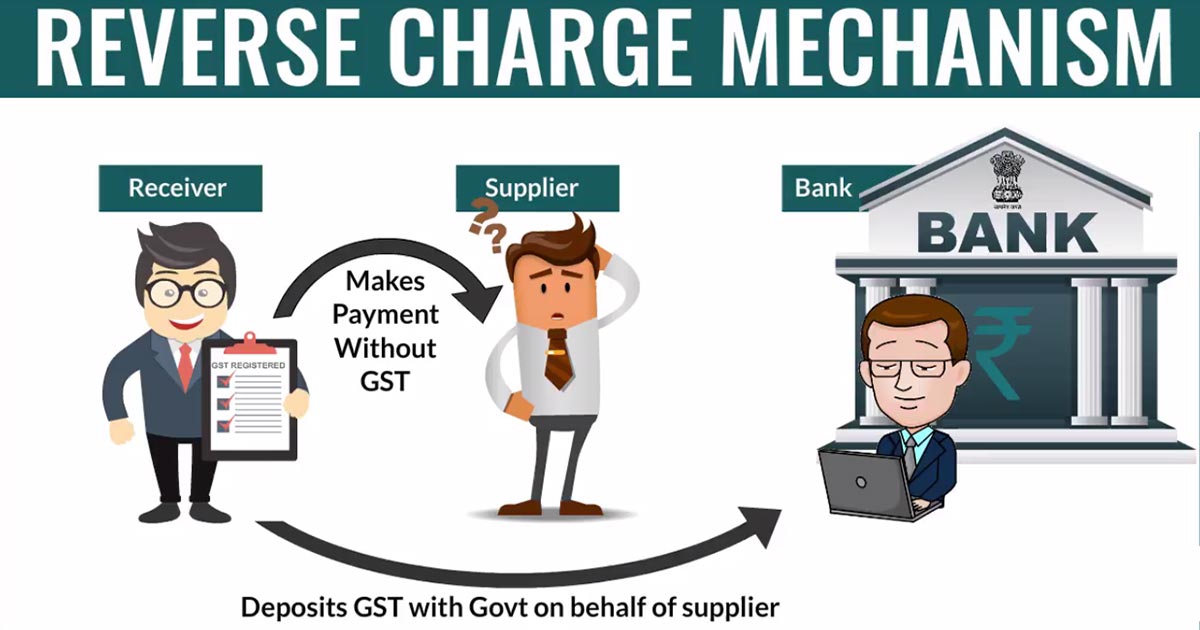

Normally, the supplier of goods or services or both charges and collects the tax from the recipient and deposits the tax with the exchequer. However, under the Reverse Charge Mechanism (“RCM”), the liability to deposit tax shifts from the supplier to the recipient. The chargeability gets reversed and all the provisions of the Central Goods and Services Tax Act, 2017(hereinafter referred to as “the Act” or “the CGST Act”) would be applicable to such a recipient as if he is the person responsible for paying the tax in relation to the supply of such goods or services or both.

Meaning of Reverse Charge

As per Section 2(98) of the Act, “reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act.

Procedural Aspects and Legal Provisions

Legal Provisions-Act, Rules, Notifications, Clarifications, Orders: –

Applicability of RCM

- Notified Goods & Services

- Supply from Unregistered person

- Import of Goods/Services

Specific goods or services notified by Government under RCM: –

Section 9(3) of the CGST Act 1 and Section 5(3) of the IGST Act-The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such……

1.Reference to the CGST Act includes reference to similar section under corresponding State Goods and Services Tax Act and Union Territory Goods and Services Tax Act.

recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Reverse Charge on Specified Goods:

The supply of goods under Reverse Charge Mechanism has notified vide Notification No. 4/2017-C.T. (Rate), dated 28-6-2017 as amended from time to time under Section 9(3) of the CGST Act, 2017 and the same is reproduced in the Table below: –

| S. No. | Tariff Item, Sub-heading, or Chapter | Description of Supply of Goods | Supplier of Goods | Recipient of Supply |

| 1. | 0801 | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| 2. | 1404 90 10 | Bidi wrapper leaves (tendu) | Agriculturist | Any registered person |

| 3. | 2401 | Tobacco leaves | Agriculturist | Any registered person |

| 3A. | 33012400, 33012510, 33012520, 33012530, 33012540, | Following essential oils other than those of citrus fruit namely: a) Of peppermint (Mentha piperita); b) Of other mints: Spearmint oil (ex-Mentha spicata), Water mint-oil (ex-Mentha aquatic), Horsemint oil (ex-Mentha ylvestries), Bergament oil (ex-mentha citrate). | Any un-registered person | Any registered person |

| 4. | 5004 to 5006 | Silk yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any registered person |

| 4A | 5201 (Effective from 15-11-2017) | Raw cotton | Agriculturist | Any registered person |

| 5. | – | Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent. Explanation. – For the purposes of this entry, lottery distributor or selling agent has the same meaning as assigned to it in clause (c) of Rule 2 of the Lotteries (Regulation) Rules, 2010, made under the 2 provisions of sub-section (1) of Section 11 of the Lotteries (Regulations) Act, 1998. |

| 6. | Any Chapter (Effective from 13-10-2017) | Used vehicles seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a Local authority. | Any registered person |

| 7. | Any Chapter (Effective from 28-5-2018) | Priority Sector Lending Certificate | Any registered person | Any registered person |

Explanation. – (1) In this Table, “tariff item”, “sub-heading”, “heading” and “Chapter” shall mean respectively a tariff item, sub-heading, heading or chapter, as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(2) The rules for the interpretation of the First Schedule to the said Customs Tariff Act, 1975, including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

Reverse charge on specified services:

The supply of services under reverse charge mechanism has been notified vide Notification No. 13/2017-C.T. (Rate), dated 28-6-2017 as amended from time to time under Section 9(3) of the CGST Act, 2017 and the list of services that will be under

reverse charge as notified by the Central Government is given in table below:

| Sl. No. | Category of Supply of Services | Supplier of Service | Recipient of service |

| 1. | Supply of Services by a Goods Transport Agency (GTA) who has not paid central tax @ 6% in respect of transportation of goods by road to- (a) any factory registered under or governed by the Factories Act,1948; or | Goods Transport Agency (GTA) | (a) any factory registered under or governed by the Factories Act,1948; or (b) any society registered under the Societies Registration Act, 1860 or under any other law for the time being in force in any part of India; or |

| (b) any society registered under the Societies Registration | (c) any cooperative society established by or under any law; | ||

| Act,1860 or under any other law for the time being in force in any part of India; or (c) any cooperative society established by or under any law; or (d) any person registered under CGST/ IGST/SGST/or UTGST Act; or (e) anybody corporate established, by or under any law; or | (d) any person registered under CGST/IGST/ SGST/UTGST Act; or(e) anybody corporate established, by or under any law; or(f) any partnership firm whether registered or not under any law including association of persons; or(g) any casual taxable person located in the taxable territory. | ||

| (f) any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person; located in the taxable territory. | |||

| “Provided that nothing contained in this entry shall apply to services provided by a goods transport agency, by way of transport of goods in a goods carriage by road, to, – (a) a department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Governmental agencies, which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under Section 51 and not for making a taxable supply of goods or services.” | |||

| 2. | Services provide by an individual advocate including a senior advocate or firm of advocates by way of legal services, directly or indirectly. | An individual advocate including a senior advocate or firm of advocates. | Any business entity located in the taxable territory. |

| Explanation. – ‘Legal service’ means any service provided in relation to advice, consultancy or assistance in any manner and includes representational services before any Court, Tribunal or Authority. | |||

| 3 | Services supplied by an arbitral Tribunal to a business entity. | An arbitral Tribunal | Any business entity located in the taxable territory. |

| 4 | Service provided by way of Sponsorship Service to anybody corporate or partnership firm. | Any person | Anybody corporate or partnership firm located in the taxable territory. |

| 5 | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding the following: (A) renting of immovable property service, and (B) services specified below: – (i) services by the Department of posts by way of speed post, life insurance, express parcel post and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. | Central Government, State Government, Union territory or Local Authority | Any Business Entity located in the taxable territory. |

| 5A | Services supplied by the Central Government, State Government, Union territory or local authority by way of renting of immovable property to a person registered under the Central Goods and Services Tax Act, 2017 (with effect from 25-1-2018. | Central Government, State Government, Union territory or Local Authority. | Any person registered under the Central Goods and Services Tax Act, 2017 |

| 5B | Services supplied by any person by way of transfer of development rights or Floor Space Index (FSI) (including additional FSI) for construction of a project by a promoter. | Any Person | Promoter |

| 5C | Long term lease of land (30 years or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price, development charges or by any other name) and/or periodic rent for construction of a project by a promoter. | Any person | Promoter |

| 6 | Services supplied by a director of a company or a body corporate to the said company or the body corporate. | A director of a company or a body corporate | A company or a body corporate located in the taxable territory |

| 7 | Services provided by an insurance agent to person carrying on insurance business. | An Insurance Agent | Any person carrying on insurance business, located in the taxable territory. |

| 8 | Services provided by a recovery agent to a banking company or a financial institution or a non-banking financial company. | A Recovery Agent | Banking company or financial institution or a non-banking financial company, located in the taxable territory. |

| 9 | Supply of Services by a music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of Section 13 of the Copyright Act, 1957 relating to original dramatic, musical or artistic works to a music company, producer or the like. | Music composer, photographer, artist, or the like. | The Music company, producer or the like, located in the taxable territory. |

| 9A | Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of subsection (1) of section 13 of the Copyright Act, 1957 relating to original literary works to a publisher. | Author | Publisher located in the taxable territory: – Provided that nothing contained in this entry shall apply where: – (i) the author has taken registration under the Central Goods and Services Tax Act,2017 (12 of 2017), and filed a declaration , in form at annexure I, within the time limit prescribed therein, with the jurisdictional CGST or SGST commissioner, as the case may be, that he exercises the option to pay central tax on the service specified in column (2), under forward charge in accordance with Section 9 (1) of the Central Goods and Service Tax Act, 2017 under forward charge, and to comply with all the provisions of Central Goods and Service Tax Act, 2017 (12 of 2017) as they apply to a person liable for paying the tax in relation to the supply of any goods or services or both and that he shall not withdraw the said option within a period of 1 year from the date of exercising such option; (ii) the author makes a declaration, as prescribed in Annexure II on the invoice issued by him in Form GST Inv-I to the publisher.”; |

| 10 | Supply of services by the members of Overseeing Committee to (Reserve Bank of India) | Members of Overseeing Committee constituted by the Reserve Bank of India. | Reserve Bank of India |

| 11 | Services supplied by individual Direct Selling Agents (DSAs) other than a body corporate partnership or limited liability partnership firm to bank or non-banking financial company (NBFCs) Effective from 27-7-2018). | Individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm. | A banking company or a non-banking financial company, located in the taxable territory. |

| 12 | Services provided by Business Facilitator (BF) to a banking company. | Business facilitator (BF) | A banking company, located in the taxable territory. |

| 13 | Services provided by an agent of Business Correspondent (BC) to Business Correspondent (BC). | An agent of Business Correspondent (BC). | A business correspondent, located in the taxable territory. |

| 14 | Security Services (services provided by way of supply of security personnel) provided to a registered person: Provided that nothing contained in the entry shall apply to, – (i)(a) a department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Government agencies; which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under Section 51 of the said Act and not for making a taxable supply of goods or services; or (ii) a registered person paying tax under Section 10 of the said Act. Sl. No. 12 to 14 vide Notification No. 29/2018-C.T. (Rate) dated 31-12-2018. w.e.f. 1-1-2019) | Any person other than a body corporate. | A registered person, located in the “taxable territory.” |

| 15 | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate. Notification No.29/2019-Central Tax (Rate), dated 31.12.2019. | Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6% to the service recipient. | Any body corporate located in the taxable territory”. |

| 16 | Services of lending securities of Securities under Lending scheme, 1997 (Scheme). Securities and Exchange Board of India (SEBI), as amended. Sl.16changes have carried vide Notification No.22/2019-C.T (Rate) dated 30.09.2019 with effect from 1’st October, 2019. | Lender i.e., a person who deposits the securities registered in his name or in the name of any other person duly authorised on his behalf with an approved intermediary for the purpose of lending under the scheme of SEBI. | Borrower i.e., a person who borrows the securities under the Scheme through an approved intermediary of SEBI). |

The cited table is showing the list of services as notified by the Government and approved by the GST Council for levy of GST under reverse charge.

Additional Services on which tax is payable by recipient under IGST Act, 2017 on Reverse charge basis under GST

- Inserted vide Notification No. 22/2019-Central Tax (Rate) dated 30-09-2019–w.e.f.1.10.2019

- Notification No-10/2017-Integrated Tax (Rate) dated 28-06-2017

| Sl. No. | Description of Services | Supplier of Service | Recipient of service |

| 1 | Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient. | Any person located in a non-taxable territory. | Any person located in the taxable territory other than non-taxable online recipient. |

| 2 | Services supplied by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the Customs Station of clearance in India. | A person located in a non-taxable territory. | Importer, as defined in Sec 2(26) of the Customs Act,1962, located in the taxable territory |

Registration:

As per Section 24(iii) of the CGST Act,

Persons who are required to pay tax under reverse charge shall be required to be registered under GST. There is no threshold limit for registration for a recipient of RCM supplies.

As per Section 25(1) of the CGST Act,

Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed.

1.Time of Supply for Goods under RCM:

As per Section 12(3) of the CGST Act, 2017 in case of supplies of goods in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely: –

(a) date of receipt of goods; or

(b) date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(c) the date immediately following 30 days from the date of issue of invoice or any other document, or similar other document thereof by the supplier:

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b) or clause (c), the time of supply shall be the date of entry in the books of account of the recipient of supply.

2.Time of Supply for Services under RCM:

As per Section 13(3) of the CGST Act, 2017 in case of supplies for Services in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely: –

(a) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(b) the date immediately following Sixty (60) days from the date of issue of invoice or any other documents, similar other document thereof by the supplier:

Provided, where it is not possible to determine time of supply by using above methods under clause (a) and clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply.

3. Invoicing Rule Under RCM:

Under reverse charge, the buyer or recipient of goods or services or both has to issue invoice or payment voucher on received of goods or services or both from the supplier as may be the case.

In terms of sub-section (3) of Section 31(3)(f) of the CGST Act, 2017 and read with clause (f) a registered person who is liable to pay tax under sub-section (3) or sub-section (4) of Section 9 of the CGST Act, shall issue an invoice in respect of goods or services or both received by him from the supplier who is not registered on the date of receipt of goods or services or both; and as per clause (g) a registered person who is liable to pay tax under sub-section (3) or sub-section (4) of Section 9 shall issue a payment voucher at the time of making payment to the supplier.

The second proviso to Rule 46 provides that where an invoice is required to be issued under Section 31(3)(f) of the CGST Act, a registered person may issue a consolidated invoice at the end of a month for supplies covered under Section 9(4), the aggregate value of such supplies exceeds rupees five thousand in a day from any or all the supplies.

Considering the inconvenience that may be caused to the stakeholders in the procedure under Section 9(4) of the CGST Act, 2017, the Central Government, therefore, issued a Notification vide No. 8/2017-C.T. (Rate), dated 28-6-2017 has given exemption to intra-State supplies of goods or services or both to the tune of Rs. 5,000/- in a day from the purview of Section 9(4) which came into effect from 1-7-2017. If the value of the supply is more than Rs. 5,000/- per day then reverse charge is applicable under Section 9(4) and Vide Notification No. 38/2017-C.T. (Rate), dated 13-10-2017 the threshold limit of Rs. 5,000/- for exemption per day kept abeyance until 31-3-2018 and also with subsequent notifications the time-line has been extended up to 30-9-2019 vide Notification No. 22/2018-C.T. (Rate), dated 6-8-2018 and the same has been rescinded.

The Central Board of Indirect Taxes & Customs (“CBIC”) has notified that Exemption from tax under ‘Reverse Charge Mechanism (RCM)’ under GST stands rescinded w.e.f. February 1, 2019 in respect of Intra-State Purchases of Goods and Services from Unregistered Dealers (of value upto Rs.5,000 per day), in view of bringing into effect, the amendments (regarding RCM on supplies by unregistered persons) in the Amended CGST/IGST/UTGST Acts, 2018. Consequently, Notification vide No. 8/2017-C.T. (Rate), dated 28-6-2017, Notification vide No. 8/2017-C.T. (Rate), dated 28-6-2017, and Notification No. 32/2017-Integrated Tax (Rate), dated the 13th October, 2017, have been rescinded vide Notifications No. 1/2019-Central Tax (Rate), No. 1/2019-Integrated Tax (Rate) and No. 1/2019-Union Territory Tax (Rate) all dated 29-1-2019.

4. Payment of Tax under RCM

As per section 49(4) of the CGST Act, the amount available in the electronic credit ledger may be used for making any payment towards output tax under this Act or under the Integrated Goods and Services TaxAct in such manner and subject to such conditions and within such time as may be prescribed.

Any liability of tax payable under reverse charge shall be discharged by debiting the electronic cash ledger. In other words, reverse charge liability cannot be discharged by using input tax credit reflecting in electronic credit ledger. However, after discharging reverse charge liability, the credit of the same can be claimed by the recipient in the same month itself, if he is otherwise eligible.

5. Input Tax Under RCM:

A supplier cannot take Input Tax Credit of GST paid on goods or services used to make supplies on which the recipient is liable to pay tax under reverse charge.

The recipient can avail Input Tax Credit of GST amount that is paid under reverse charge on receipt of goods or services by him.

GST paid on goods or services under reverse charge mechanism is available as ITC to the registered person provided that such goods or services are used or will be used for business or furtherance of business.

The ITC is availed by recipient cannot be used towards payment of output tax on goods or services, the payment of tax under reverse charge only on cash.

Late Fee:

- If registered Person fails to furnish the details of Outward or Inward supplies by the due date shall pay late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees.

- Any registered person who fails to furnish the return required undersection 44 by the due date shall be liable to pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum of an amount calculated at a quarter per cent of his turnover in the State or Union territory.

Note:

•Under RCM liability to pay tax is on the recipient of supply of goods or services or both.

•Reverse charge shall be applicable in case of supply of taxable goods and/or services by unregistered supplier to a registered recipient.

•Supply by an unregistered supplier to another unregistered recipient does not attract reverse charge.

•Exempted Goods / Service received from an un-registered person are not covered under reverse charge mechanism.

•Compulsory registration is required to be obtained by the recipient, if the if supply attracts reverse charge.