Are you confused about whether to opt for the Old or New Tax Regime this year? You’re not alone. With the Income-tax Act now offering two parallel systems, understanding which is better for your financial situation is crucial.

In this post, we break down the differences, benefits, and suitability of each regime for AY 2025-26 (FY 2024-25).

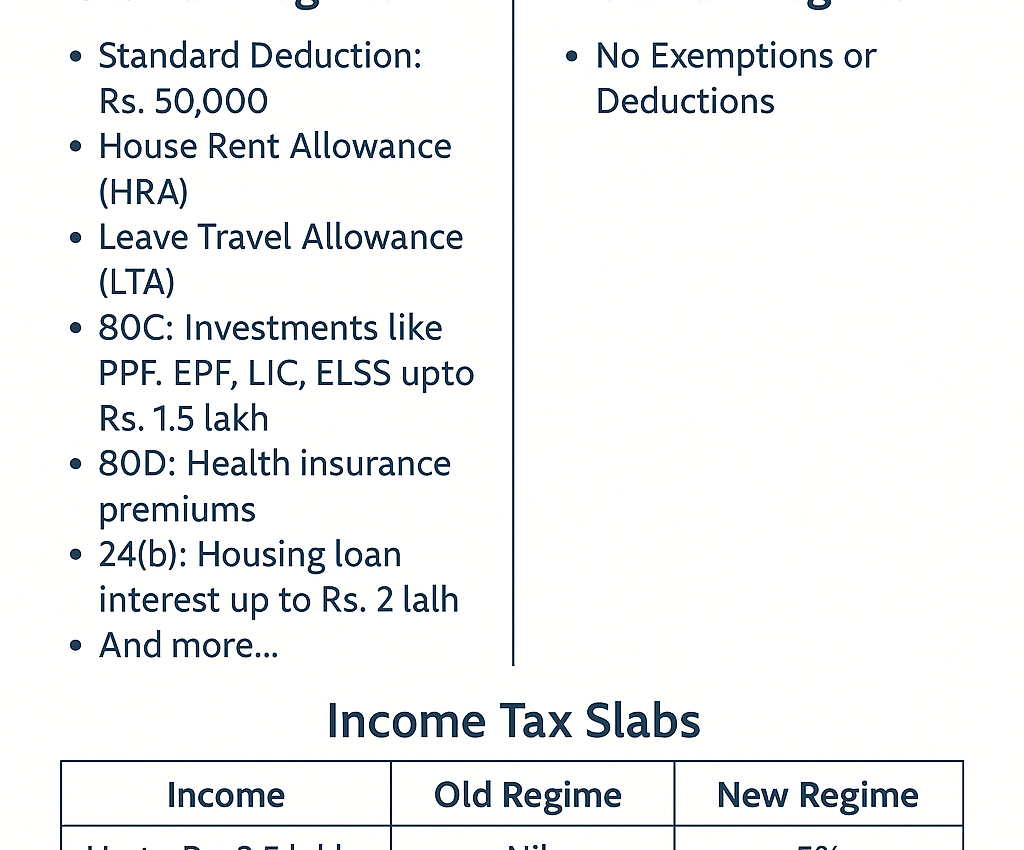

Tax Slabs: Old vs New Regime

New Tax Regime

The New Regime offers lower tax rates but removes most deductions.

| Annual Income | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹6,00,000 | 5% |

| ₹6,00,001 – ₹9,00,000 | 10% |

| ₹9,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

.

Old Tax Regime

This regime retains all popular deductions and exemptions.

| Annual Income | Tax Rate (for individuals below 60) |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Deductions Available Under Old Regime

- Section 80C: Up to ₹1.5 lakh for LIC, PPF, ELSS, etc.

- Section 80D: Health insurance (₹25,000–₹1,00,000)

- Home Loan Interest: Section 24(b) – up to ₹2 lakh

- HRA, LTA, and Standard Deduction

- Education Loan Interest: Section 80E

- Other Chapter VI-A deductions

Which Regime Is Better for You?

| If You… | Recommended Regime |

|---|---|

| Have home loan, LIC, PPF, MF, etc. | Old Regime |

| Are salaried with HRA benefits | Old Regime |

| Have no major deductions or investments | New Regime |

| Are a freelancer or professional without tax-saving plans | New Regime |

Which Regime Is Better for You?

| If You… | Recommended Regime |

|---|---|

| Have home loan, LIC, PPF, MF, etc. | Old Regime |

| Are salaried with HRA benefits | Old Regime |

| Have no major deductions or investments | New Regime |

| Are a freelancer or professional without tax-saving plans | New Regime |

Example: Annual Income ₹12,00,000

| Details | Old Regime | New Regime |

|---|---|---|

| Deductions Claimed | ₹3,00,000 | ₹50,000 |

| Taxable Income | ₹9,00,000 | ₹11,50,000 |

| Tax Payable (Approx.) | ₹95,400 | ₹97,500 |

Verdict: If you’re claiming multiple deductions, the Old Regime can offer better tax savings.

Example: Annual Income ₹12,00,000

| Details | Old Regime | New Regime |

|---|---|---|

| Deductions Claimed | ₹3,00,000 | ₹50,000 |

| Taxable Income | ₹9,00,000 | ₹11,50,000 |

| Tax Payable (Approx.) | ₹95,400 | ₹97,500 |

Key Points to Remember

- Salaried individuals can choose the regime every year while filing the return.

- Business/professional income? You can opt out of the New Regime only once.

- Plan investments wisely to make the most of the Old Regime.